Canada T4 2012 modèle imprimable gratuit

Afficher les détails

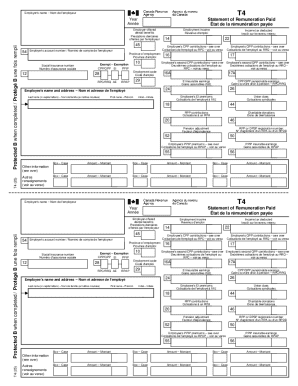

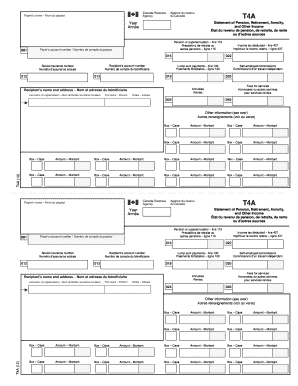

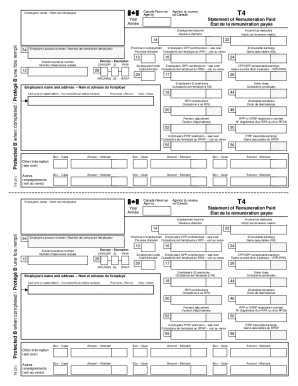

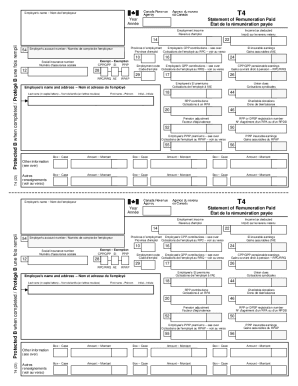

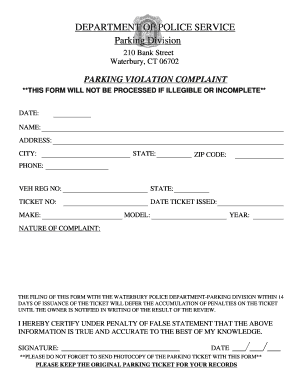

T4 Employer's name Not de l'employer Year Ann e STATEMENT OF REMUNERATION PAID TAT DE LA R MUN RATION PAY E Employment income line 101 Revenue d'employ line 101 Income tax deducted line 437 Imp t

Nous ne sommes affiliés à aucune marque ou entité sur ce formulaire

Obtenez, créez, fabriquez et signez Canada T4

Modifier votre Canada T4 formulaire en ligne

Tapez du texte, des champs remplissables et insérez des images, des données en surbrillance ou en panne à la discrétion, ajoutez des commentaires, et plus encore.

Ajoutez votre signature légale

Dessinez ou tapez votre signature, téléchargez une image de signature ou saisissez-la avec votre appareil photo numérique.

Partagez votre formulaire instantanément

E-mail, fax, ou partagez votre Canada T4 via l'URL. Vous pouvez également télécharger, imprimer ou exporter des formulaires vers votre service de stockage cloud préféré.

Édition en ligne de Canada T4

Suivez les étapes ci-dessous pour utiliser un éditeur PDF professionnel :

1

Inscrivez-vous sur votre compte. Si vous êtes nouveau, c'est le moment de commencer votre essai gratuit.

2

Téléchargez un document. Sélectionnez Ajouter nouveau sur votre tableau de bord et transférez un fichier dans le système de l'une des manières suivantes : en le téléchargeant depuis votre appareil ou en important depuis le cloud, le web, ou le courrier interne. Ensuite, cliquez sur Commencer l'édition.

3

Éditez Canada T4. Réarrangez et faites pivoter les pages, ajoutez et modifiez le texte, et utilisez des outils supplémentaires. Pour enregistrer les modifications et revenir à votre tableau de bord, cliquez sur Terminé. L'onglet Documents vous permet de fusionner, diviser, verrouiller ou déverrouiller les fichiers.

4

Enregistrez votre fichier. Sélectionnez-le dans la liste de vos enregistrements. Ensuite, déplacez le curseur vers la barre d'outils droite et choisissez l'une des méthodes d'exportation disponibles : enregistrez-le dans plusieurs formats, téléchargez-le au format PDF, envoyez-le par e-mail, ou stockez-le dans le cloud.

pdfFiller rend le traitement des documents un jeu d'enfant. Créez un compte pour le découvrir !

Sécurité sans compromis pour vos besoins en édition de PDF et de signature électronique

Vos informations privées sont en sécurité avec pdfFiller. Nous utilisons un chiffrement de bout en bout, un stockage cloud sécurisé et un contrôle d'accès avancé pour protéger vos documents et maintenir la conformité réglementaire.

Canada T4 Versions de formulaire

Version

Popularité du Formulaire

Complable & imprimable

Comment remplir Canada T4

Comment remplir Canada T4

01

Rassemblez toutes les informations nécessaires sur les employés, y compris leurs noms, adresses et numéros d'assurance sociale.

02

Calculez les montants des salaires et des déductions pour chaque employé sur la période de l'année fiscale.

03

Remplissez le formulaire T4 avec les informations de chaque employé, en indiquant les montants gagnés et les retenues d'impôt.

04

Vérifiez l'exactitude des informations avant de soumettre le formulaire.

05

Fournissez une copie du T4 à chaque employé et soumettez le fichier à l'Agence du revenu du Canada avant la date limite.

Qui a besoin de Canada T4?

01

Tous les employeurs au Canada qui versent des salaires à leurs employés doivent remplir un formulaire T4.

02

Les travailleurs indépendants qui versent des salaires doivent également utiliser le T4 pour déclarer les paiements faits à leurs employés.

Remplir

form

: Essayez sans risque

Les gens demandent aussi à propos de

How do I download a T4 form?

How Can I Get My T4? If you need a T4 slip for the current tax year, your employer should be able to provide it to you. For previous tax years, you can request a copy from the Canada Revenue Agency (CRA) or by calling 1-800-959-8281. Get Your T4 and Other Tax Forms Online From CRA's “Auto-fill my return”

Can I request a T4?

How Can I Get My T4? If you need a T4 slip for the current tax year, your employer should be able to provide it to you. Employers are required to provide T4s by the end of February. For previous tax years, you can request a copy from the Canada Revenue Agency (CRA) or by calling 1-800-959-8281.

Where can I get T4 forms online?

You can also access your T4 online through the Canada Revenue Agency (CRA) through My Account for Individuals. This secure portal lets you view and manage your income tax and benefit information in a few clicks.

Can I get my T4 emailed to me?

6. Can an employer issue the T4 slip by email under the new rules? No. The T4 slip contains sensitive taxpayer information and general email communication does not contain sufficient security features to be permitted under the new rules when consent is not provided by the employee.

Is T4 available online?

Your tax slips will always be available online in MSCA, even if you choose to receive them by mail. To change your mailing option: register or sign in to MSCA. go to “Tax information”

How can I download my T4?

You can ask your current or former employers for a copy of your T4 for the current tax year or previous years. Employers must keep paper and electronic records on file for six years. You can also access your T4 online through the Canada Revenue Agency (CRA) through My Account for Individuals.

Les avis de nos utilisateurs parlent d'eux-mêmes

Lisez plus ou essayez pdfFiller pour profiter des avantages par vous-même

Pour la FAQ de pdfFiller

Vous trouverez ci-dessous une liste des questions les plus courantes des clients. Si vous ne trouvez pas de réponse à votre question, n'hésitez pas à nous contacter.

Comment puis-je exécuter Canada T4 en ligne ?

Remplir et signer Canada T4 est maintenant simple. La solution vous permet de modifier et de réorganiser le texte PDF, d'ajouter des champs remplissables et de signer électroniquement le document. Lancez un essai gratuit de pdfFiller, la meilleure solution d'édition de documents.

Puis-je signer électroniquement Canada T4 dans Chrome ?

Oui. Avec pdfFiller pour Chrome, vous pouvez signer électroniquement des documents et utiliser l'éditeur PDF tout en un. Créez une signature électronique légalement contraignante en la dessinant, en la tapant ou en téléchargeant une image de votre signature manuscrite. Vous pourrez signer électroniquement Canada T4 en quelques secondes.

Comment puis-je remplir Canada T4 en utilisant mon appareil mobile ?

L'application mobile pdfFiller facilite la création et le remplissage de formulaires légaux. Remplissez et signez Canada T4 et d'autres documents avec l'application. Visitez le site web de pdfFiller pour en savoir plus sur les fonctionnalités de l'éditeur PDF.

Qu'est-ce que Canada T4?

Le Canada T4, ou feuillet T4, est un document fiscal qui résume le revenu d'emploi d'un individu ainsi que les retenues d'impôt sur le revenu pour une année d'imposition donnée.

Qui doit déposer Canada T4?

Les employeurs au Canada doivent déposer un feuillet T4 pour chaque employé qu'ils ont rémunéré au cours de l'année fiscale.

Comment remplir Canada T4?

Pour remplir un feuillet T4, les employeurs doivent rassembler les informations sur les salaires versés, les retenues d'impôt, les cotisations à l'assurance emploi, et d'autres déductions, puis les inscrire sur le formulaire T4 correspondant.

Quel est le but de Canada T4?

Le but du Canada T4 est de renseigner à la fois l'employé et l'Agence du revenu du Canada (ARC) sur les revenus d'emploi ainsi que sur les impôts retenus tout au long de l'année, facilitant ainsi la déclaration des impôts.

Quelles informations doivent être déclarées sur Canada T4?

Les informations qui doivent être déclarées sur un feuillet T4 incluent le nom et l'adresse de l'employé, son numéro de sécurité sociale, les montants des salaires, les retenues d'impôt, les cotisations à l'assurance emploi et au régime de pensions du Canada.

Remplissez votre Canada T4 en ligne avec pdfFiller !

pdfFiller est une solution de bout en bout pour gérer, créer et éditer des documents et des formulaires dans le cloud. Gagnez du temps et évitez les tracas en préparant vos formulaires fiscaux en ligne.

Canada t4 n'est-ce pas le formulaire que vous recherchez ?Recherchez un autre formulaire ici.

Mots-clés pertinents

Formulaires Connexes

Si vous pensez que cette page doit être retirée, veuillez suivre notre processus de décollage DMCA

ici

.

Ce formulaire peut inclure des champs pour les informations de paiement. Les données saisies dans ces champs ne sont pas couvertes par la conformité PCI DSS.